Tips for Saving Money this Summer

With summer right around the corner, it can be overwhelming to think about all the expenses that come this time of the year. Well, we have some good news for you- it doesn’t have to be that way! Additional expenses will definitely come up but it is possible to keep them as low as possible. With a little bit of planning and amazing tips from TD Canada Trust, we can definitely save a lot of money this summer.

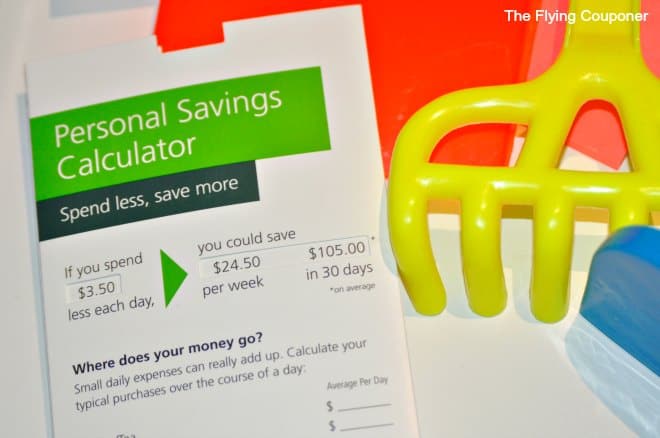

According to a recent TD survey, 55% of Canadian parents with children under the age of 18 take on additional costs during the summer; in fact, 71% of them spend up to $999 per child. The most common additional costs include vacations, day trips, classes, summer camps, and sporting activities. No matter how you plan to pay for these expenses, it is always a good idea to plan ahead by saving during the year and to cut back on other costs. I know, I like my extra hot, extra foam, and extra espresso cappuccino but I am willing to cut down on my caffeine fix a little. If I spend $3.50 less each day, I will save $24.50 per week. That’s $105 in 30 days! Check out TD’s budgeting and planning tools to help you out.

For saving on summer activities, Linda MacKay, Senior Vice President, Retail Savings and Investing and Shirley Malloy Associate Vice President, Acquisition & Sales Management from TD Canada Trust tell us that there are many different ways to do it:

• Check your rewards balance – redeem some of your loyalty rewards, such as points from your First Class Travel Credit Card, to help fund activities and travel. For example, you can use your loyalty rewards to redeem certain theme park passes or tours and excursions.

• The early bird gets the worm – some organizations may provide a discount on early registration; check the sign up dates and sign up in advance to save a few dollars.

• Budget and start saving early – save a little money each month and put into your TFSA; online budgeting tools, visit tdcanadatrust.com, can also help you determine how much to save each month.

• Shop around – municipally run activities through community centres or the parks and recreation department often offer lower cost programming.

• File your receipts – some summer costs could be tax deductible as a child care expense or under the child fitness tax credit on your tax return

No matter how you plan to save money this summer, I know that we can all do it! Have fun and happy savings!

This post was generously sponsored by TD Canada Trust, but all opinions and images are my own.

Filing your receipts is so important. Don’t LOSE your receipts either! 🙂

very handy tips, thank you for this 🙂

These are great money saving tips. My favorite is redeeming reward points. I have been able to purchase products at a reduced price by using my reward points. Thank you for sharing these tips.